Fossil fuel subsidies are a vexed and peculiar topic. On one hand, everyone seems to agree they’re bad and should be eliminated (it’s in Biden’s jobs bill, for instance). On the other hand, they never go anywhere.

In part, it’s because we lack a clear understanding of what constitutes a subsidy and what impact they have. Analysts are forever arguing over exactly what counts, trying to tally up the total subsidies fossil fuels receive, but there are very few bottom-up attempts to document the concrete effects of subsidies on the economics of oil and gas projects.

That’s why I was interested in this new paper in Environmental Research Letters, by Ploy Achakulwisut and Peter Erickson of the Stockholm Environment Institute and Doug Koplow of Earth Track. It breaks down the effect of 16 specific, direct US fossil fuel subsidies on the profitability and emissions of US oil and gas production.

As for those subsidies, there are three basic categories: “forgone government revenues through tax exemptions and preferences; transfer of financial liability to the public; and below-market provision of government goods or services.” (Note that this study does not get into unpriced environmental externalities like air pollution and greenhouse gases, which are themselves a kind of subsidy.)

Subsidies either enrich oil & gas investors or spur new oil & gas projects

One reason there aren’t many bottom-up analyses like this is that it’s devilishly difficult to pin down the economic effect of a subsidy. Doing so always involves a counterfactual baseline — what would have happened absent the subsidy. Anytime counterfactuals are involved, there lots of assumptions to make and variables to account for.

To take just a couple of examples, the effect a subsidy will have on the decision whether to invest in a new oil and gas project will depend on oil and gas prices and the hurdle rate. (The hurdle rate is the rate of return investors require to fully cover risks; more aggressive decarbonization efforts will presumably mean more risk and thus a higher hurdle rate.) The study actually runs several different scenarios based on different values for those variables, producing a cost curve for each region of the US. It gets complicated.

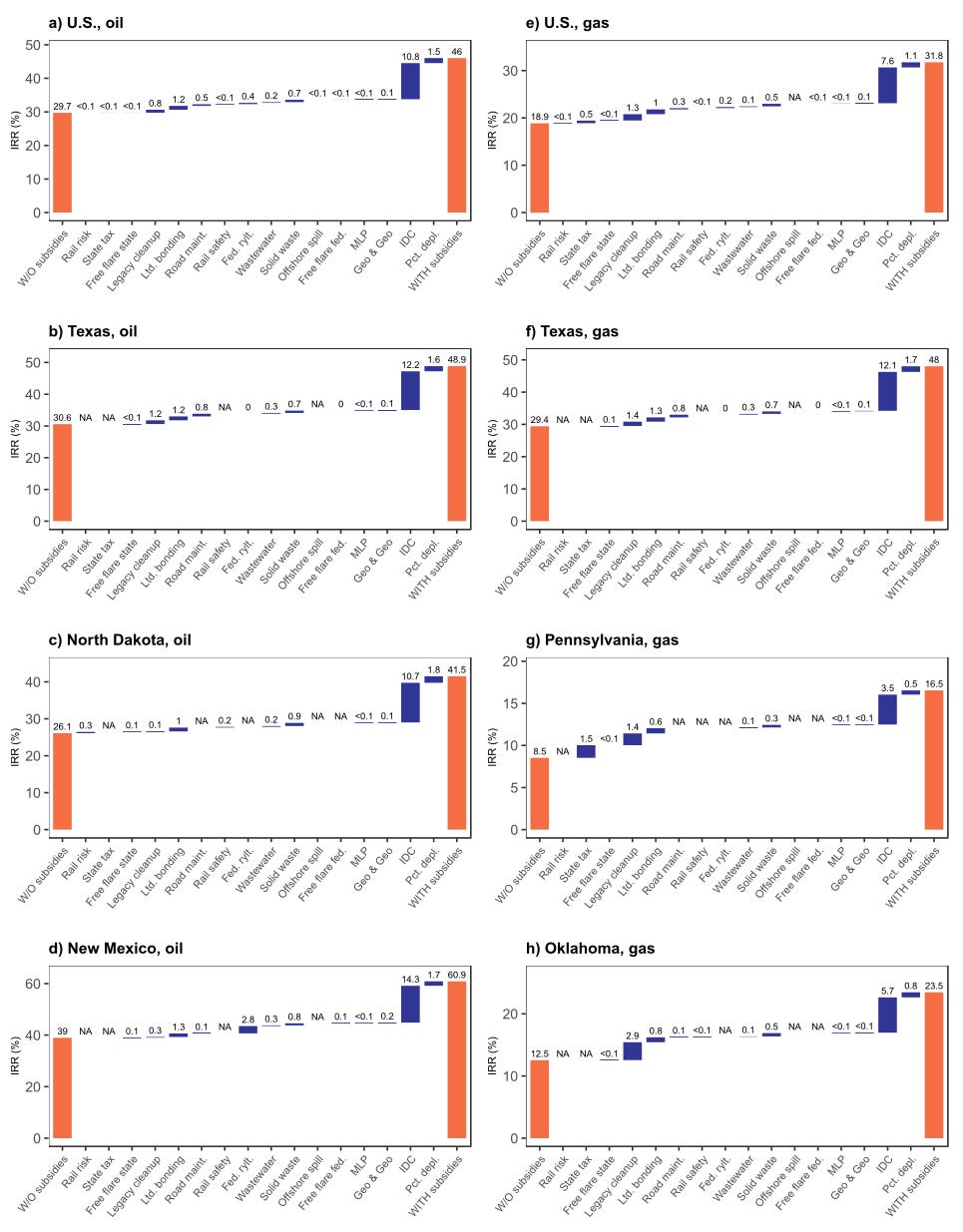

For clarity, they chose to highlight two scenarios: 2019’s higher oil and gas prices with a 10 percent hurdle rate and 2020’s lower prices with a 20 percent hurdle rate. Here are the results:

We find that, at 2019 average market prices of oil and gas, the 16 subsidies could increase the average rates of return of yet-to-be-developed oil and gas fields by 55% and 68% over unsubsidized levels, respectively, with over 96% of subsidy value flowing to excess profits under a 10% hurdle rate. At lower 2020 prices, the subsidies could increase the average rates of return of new oil and gas fields by 63% and 78% over unsubsidized levels, respectively, with more than 60% of oil and gas resources being dependent on subsidies to be profitable under a 20% hurdle rate.

The way to think about this is, subsidies can have one of two negative effects, depending on market circumstances.

With higher prices and a lower hurdle rate, “only 4 percent of new oil and 22 percent of new gas resources would be subsidy-dependent, pushed into making profits,” Achakulwisut told me. That means most of the projects didn’t really need subsidies and the extra money is all going to bigger profit margins for oil and gas investors.

With lower prices and a higher hurdle rate, “subsidies would matter a lot,” she says, “and 61 percent of new oil and 74 percent of new gas would be subsidy-dependent.” The subsidies would directly lead to more production.

Achakulwisut summarizes: “In one case, it's going to profit, amplifying the incumbent status of the oil and gas industry. In another, under more aggressive decarbonization policy and low oil and gas prices, it's actively working against the climate goal by spurring additional production.”

Either of those effects is bad. In 2021, we don’t want bigger profit margins for oil and gas companies and we don’t want more oil and gas production.

One subsidy to rule them all

What’s interesting is that the benefits to oil and gas are not spread evenly over different subsidies. In fact, one in particular dwarfs the others: the expensing of intangible exploration and development costs (“intangible drilling costs,” or IDC), a policy that’s been around for over a century.

The chart below shows the “average effect of each subsidy on the internal rate of return (IRR) of new, not-yet-producing oil and gas fields, at average 2019 prices of USD2019 64/barrel of oil and USD2019 2.6/mmbtu of gas.”

As you can see, in every region, the IDC deduction is the dominant subsidy. It “increases US-wide average IRR by 11 and 8 percentage points for oil and gas fields respectively.”

The IDC deduction has been the subject of controversy for ages. The Committee for a Responsible Federal Budget (CRFB) has a good breakdown here. A definition:

Intangible drilling costs are defined as costs related to drilling and necessary for the preparation of wells for production, but that have no salvageable value. These include costs for wages, fuel, supplies, repairs, survey work, and ground clearing. They compose roughly 60 to 80 percent of total drilling costs.

Since the dawn of the federal income tax code in 1912, US law has allowed oil and gas companies to deduct all these costs up front, rather than as they are incurred. The idea is to defray the risk that an exploration project will come up dry; in practice, it’s a fat financial reward at the front end of every project.

The industry and its defenders offer an array of arguments in favor of the deduction, which CRFB adeptly summarizes:

Supporters of the deduction argue that oil and gas and exploration and development is a high-cost industry, and allowing expenses to be recovered immediately encourages companies to invest. They explain that altering the deduction could result in job losses, since wages are included in the deduction.

More broadly, supporters point out that the oil and gas industry receives the same treatment that other manufacturing or extractive industries receive, and are merely a target because of the now-controversial nature of reliance on fossil fuels. Finally, supporters of energy independence often support the IDC deduction, as it promotes further exploration and development of wells within the United States.

The thing is, all those arguments are true. But the subsidy is still bad.

Yes, deducting IDCs encourages investment in new oil and gas projects and creates new jobs. That’s what subsidies do! It just happens that we no longer want to encourage investment in oil and gas.

Yes, other manufacturing and extractive industries get similar deductions. The difference is that we want to encourage investment in those other industries and we no longer want to encourage investment in oil and gas. That’s the whole point.

The issue is not whether the subsidy does what it’s designed to do. It does. The question is whether we still want to do the thing it does. We do not.

People have been calling for removal of this subsidy for decades. It’s still a good idea.

Oil and gas also benefits from offloading its environmental regulatory costs onto the public

The other subsidies that substantially boost oil and gas profit margins are “regulatory exemptions that lower [oil and gas] production costs at the expense of the health and safety of workers and the public.” Two such exemptions shift financial liability for well closure and reclamation from companies to state governments, which saddles places with lots of abandoned wells — Texas, Pennsylvania, and Oklahoma, for example — with an average of $10 billion a piece in remediation costs, which well exceeds what those states have set aside in cleanup funds.

Another allows oil and gas to treat solid wastes from extraction as non-hazardous, despite the fact that they frequently contain toxic chemicals or radioactive materials. This reduces per-well operational costs an average of $60,000.

Keep in mind, this study didn’t try to tally up the public health benefits of removing these subsidies. Others have done so, like a recent study from Yale’s Matthew Kotchen that tried to tally up the “implicit subsidies” to US fossil fuel producers represented by “externalized environmental damages, public health effects, and transportation-related costs.” His conclusion:

The producer benefits of the existing policy regime in the United States are estimated at $62 billion annually during normal economic conditions. This translates into large amounts for individual companies due to the relatively small number of fossil fuel producers.

Those implicit subsidies are far larger than any direct subsidies. In 2017, the International Monetary Fund tried to tally up implicit subsidies across the globe and came up with an eye-popping $5.2 trillion.

Like much climate policy, removing fossil fuel subsidies requires directly confronting fossil fuels

I take three things from this research. One, fossil fuel subsidies really do strengthen the economics of US oil and gas companies and accelerate investment and exploration. That’s what they’re designed to do, and they do it. Two, the oil and gas industry really does materially benefit from being allowed to offload its environmental risks onto the public.

And three, the deduction for intangible drilling costs is the main fight. It is the big subsidy, the one that’s actually pushing new oil and gas projects over the line into profitability, and it is a much more specific target than “fossil fuel subsidies.” It seems like something some clever group ought to be able to build a campaign around.

It’s worth noting that Joe Biden’s proposed 2021 budget would eliminate the IDC deduction, along with a host of other fossil fuel subsidies. Then again, Obama included the same kinds of provisions in virtually every one of his budgets, and Congress never complied. Like I said, fossil fuel subsidies just hang around.

In this way, they represent the sad reality of federal climate policy in the US, which involves a lot of heady talk and future targets, but very little that would confront fossil fuel industries head-on over the next decade. (I wrote about this the other day.)

The problem is that the benefits of fossil fuel exploration and production are concentrated in a few regions and communities and the members of Congress who represent those communities are hyper-motivated to preserve existing advantages. In contrast, the benefits of ramping down fossil fuel production are spread out, geographically and temporally, so few members of Congress will champion it with the same vigor.

That’s how climate policy runs aground in the US — in the translation from high-flown rhetoric to policies that will materially affect the bottom lines of fossil fuel companies.

This study offers us a marker of serious commitment: repealing the deduction for IDCs. When Congress actually gets around to addressing that age-old subsidy, we’ll know we’re finally getting somewhere.

Subsidies really do matter to the US oil & gas industry -- one in particular