When a company or city claims to be “100 percent powered by clean energy,” what it typically means is that it has tallied up its electricity consumption, purchased an equal amount of carbon-free energy (CFE), and called it even.

That’s fine, as far as it goes. But now, the next horizon of voluntary climate action has come into view: a brave few companies and cities aspire, not just to offset their consumption with CFE on a yearly basis, but to match their consumption with CFE production every hour of every day, all year long. Running on clean energy 24/7 — that’s new hotness.

The list of entities in the US that have committed to 24/7 CFE is short: Peninsula Clean Energy (a community choice aggregator in California) has committed to it by 2025; Google, Microsoft, and the Sacramento Municipal Utility District have targeted 2030; the Los Angeles Department of Water and Power and, somewhat anomalously for this California-heavy list, the city of Des Moines, Iowa, have targeted 2035. Ithaca, New York, is rumored to be contemplating something similar.

That’s it for now. But the idea is catching on quickly and drawing tons of attention. In September, a broad international group of more than 40 energy suppliers, buyers, and governments launched the 24/7 Carbon-free Energy Compact, “a set of principles and actions that stakeholders across the energy ecosystem can commit to in order to drive systemic change.”

Biden’s original American Jobs Plan contained a promise to pursue “24/7 clean power for federal buildings.” That language has fallen out of the Build Back Better budget reconciliation bill in Congress, but rumor has it Biden may issue an executive order on the subject soon.

There are already efforts afoot to standardize hourly tracking of clean energy and build it into markets, as well as numerous active discussions about how to update markets and policy to accommodate it.

Anyway, it’s getting to be a big deal. It’s time to wrap our heads around what’s going on. Happily, it turns out to be a fascinating story with all kinds of twists and turns. Let’s dive in!

A history of “powered by clean energy”

To understand what “100 percent powered by clean electricity” has meant to date, you have to understand at least the basics of renewable energy certificates, or RECs.

Originally, RECs were a mechanism that utilities used to comply with statutory requirements for deploying renewable energy. A wind or solar farm that generated 1 megawatt-hour of renewable energy also generated 1 REC, which was submitted to regulators as proof of compliance.

Then voluntary REC markets came along. In a voluntary REC market, a power generator can “unbundle” its REC from the megawatt-hour of energy it generates and sell it into a market where it could be traded numerous times before being retired, or taken off the market. (For accounting purposes, whoever retires the REC gets to claim the environmental benefits.) Corporate, institutional, and government entities could purchase, trade, and retire RECS.

The idea was that the ability to sell RECs as a second income stream would induce developers to build more clean energy projects. And it worked for a while, as long as solar and wind came at a cost premium and RECS were relatively expensive.

But then, wind and solar started getting super-cheap: the cost of an unbundled REC went from $5 in 2008 to under $1 in 2010 (where it stayed through 2019, though it has risen back up to $3-$5 in the last couple years). Voluntary REC markets became quite robust but it became clear at a certain point that all these unbundled RECs were not actually driving many new renewable energy projects. A 2013 study found that “the investment decisions of wind power project developers in the United States are unlikely to have been altered by the voluntary REC market.”

To their credit, corporate and industrial (C&I) buyers took notice. In 2014, Walmart stated that it would no longer offset its energy use with unbundled RECs, and many other buyers followed suit. The market began to trend toward long-term contracts — power purchase agreements (PPAs) — through which a buyer pledged to buy both the energy and the RECs (“bundled” RECs) from a prospective project for 10 to 25 years.

That gave developers more confidence and has prompted a surge of building of clean energy projects. In 2020 alone, C&I buyers in the US procured 10.6 gigawatts of renewable energy, which represents a third of all renewables capacity added in the country. Voluntary procurement by the C&I sector has become a major driver of the energy transition.

There are still plenty of entities buying cheap unbundled RECs and claiming carbon neutrality, but the leaders in the space are generally bundling them under PPAs.

But there is still a problem with RECs, even the good ones.

The problem with RECS

When a C&I buyer purchases a REC, whether bundled or unbundled, it knows how much renewable energy was generated (a megawatt-hour), but not when it was generated. But it turns out that, when it comes to energy sources that come and go with the weather like wind and solar, the timing of generation matters quite a bit.

If participants in voluntary REC markets continue to buy the cheapest wind and solar RECs, sooner or later, the grid will become imbalanced. During periods of high sunlight or heavy wind, there will be too much renewable energy, pushing prices down.

But in periods when the sun is down or the wind flags, there isn’t enough renewable energy, so demand must be covered by expensive natural gas peaker plants. Prices and supplies swing wildly. Markets don’t like it. And more wind and solar only exacerbate the effect.

What’s needed is CFE that’s available when sun and wind fall short. A megawatt-hour of additional CFE is much more valuable during those times than it is during times of high solar and wind output. The timing matters.

But right now, RECs contain no information about the time of generation. It is impossible for buyers to know if any particular generator covered or will cover any particular hour of consumption. Buyers have no way of buying CFE specifically in the hours that they most need it.

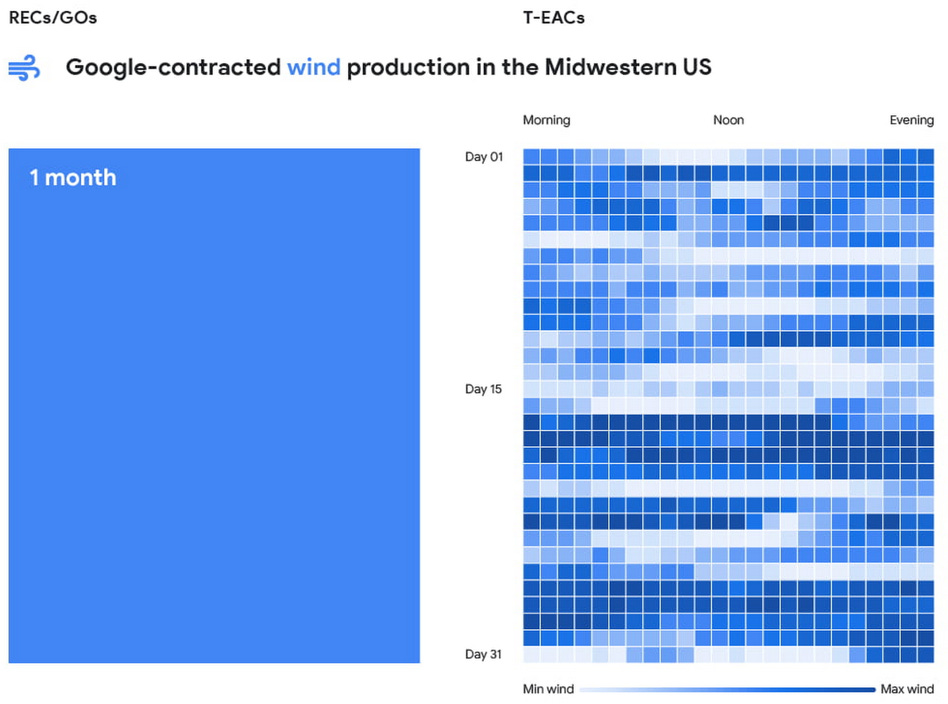

Think of a monthly REC as an extremely low-resolution image of renewable energy production. In temporal terms, it’s one giant month-sized pixel. C&I buyers purchase these low-resolution images, overlay them on their consumption, and hope for the best.

But when you look at a higher resolution image of renewable energy production, one with hour-sized pixels, you see that it does not overlap perfectly with consumption. Not even close.

The mismatch between “100% CFE” and “100% CFE 24/7”

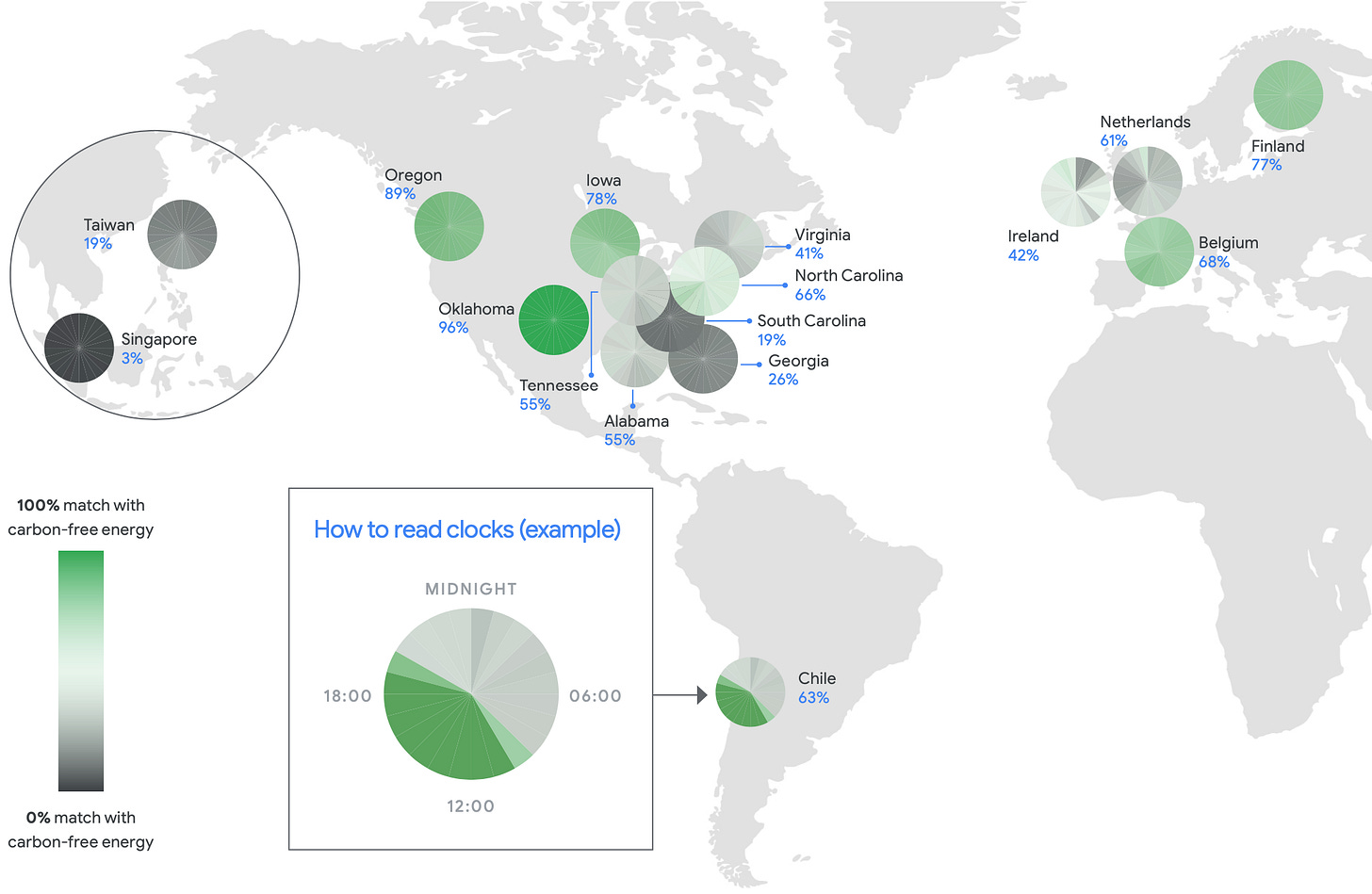

Google broke ground in this area with a 2018 white paper called “The Internet is 24x7. Carbon-free energy should be too.” (See also this 2020 white paper and this April blog post from Google CEO Sundar Pichai.) It has produced some visuals that allow us to clearly see the mismatch between renewable energy supply and demand.

Google has dozens of data centers. It tracks energy supply and demand by the hour and gives each data center a CFE score: how many hours of its operations were powered, in real time, by renewable energy.

A quick word about how the CFE score is calculated. For each hour, the baseline CFE score is the grid mix. So if the data center is drawing on a grid with 20 percent CFE (wind, solar, nuclear, whatever) and 80 percent fossil, it begins with a CFE score of 20 percent for that hour.

Google then adds any energy being produced during that hour by projects with which it has signed PPAs on the same grid. That can push the CFE score up, theoretically to 100 percent.

Anyway, with that in mind, let’s check out some data centers and their CFE scores. The first is from the company’s data center in Iowa.

Google buys more than enough wind power in Iowa to offset the data center’s consumption in volumetric terms. But is the data center actually running on wind power, from hour to hour? Not entirely. To be precise, 74 percent of its demand was matched, on an hourly basis, by CFE. It has a CFE score of 74.

Below is a stripe representing the data center’s consumption for every hour of the year. Each column is a day (there are 365). Each row is an hour, beginning with midnight at the top. The shade of the square represents the amount of CFE powering it during that hour.

In most hours, there’s enough Google-contracted wind power coming onto the Iowa grid to cover the data center’s consumption. However, for a period in late summer, wind speeds decline, wind power drops, and fossil fuels step in to provide the power.

How can Google get this data center’s CFE score up to 100 percent?

The first thing to note is that it can not simply buy more Iowa wind power. It is already getting all it can get out of wind. It doesn’t matter how many wind farms it has contracted with if the wind isn’t blowing in a given hour. In Iowa, Google is going to have to procure something else — something that can fill in the gaps left by wind.

One way to do that is by buying both wind and solar, which tend to have complementary profiles. Below is a similar stripe representing Google’s Netherlands data center. On July 1, a bunch of new Google-contracted solar came online; from that point on, the middle of the stripe — daytime — is much greener. Solar fills in some of the gaps left by wind.

Unfortunately, solar leaves gaps too. It doesn’t matter how many solar farms you’ve contracted with if the sun is behind clouds or, you know, down. In the Netherlands, Google is going to have to procure something else — something to fill the remaining gaps left by solar and wind.

In some sense, these are nice problems to have. Here’s the Taiwan data center:

Oof. What little CFE there is on Taiwan’s grid comes from nuclear power plants — when they go out, it’s all fossils.

Google has given all of its data centers CFE scores (which was no mean feat, since in many cases this data was not easily available). Here they are:

These graphics help illustrate Google’s 24/7 CFE challenge, which isn’t just one challenge but a slightly different challenge in each of the dozens of grids in which it operates.

At each of those data centers (except maybe Oklahoma and Oregon) it needs to buy a bunch more wind and solar. But it will also need to buy something else — something to fill the gaps.

What might that something else be?

The technology needed to fill the gaps

Part of the great promise of the movement to 24/7 CFE is it will draw attention and investment to all those things needed to balance out cheap wind and solar.

For big consumers like Google, there are, roughly speaking, three ways to smooth out the fluctuations in wind and solar and maintain a steady hourly supply of CFE. They are, from least to most expensive: demand management, energy storage, and clean-firm generation.

Demand management

Demand management begins with load reduction through efficiency. Google has aggressively pursued energy efficiency at its data centers, with dramatic results: “Compared with five years ago,” the company said in 2018, “we now deliver more than 3.5 times as much computing power with the same amount of electrical power.”

After load reduction comes load shaping — managing daily operations to push more consumption into high-CFE hours — and load shifting, which refers to moving consumption around in smaller increments, responding to hour-to-hour fluctuations in CFE.

“We got our start by looking out over a 24-hour period, getting a forecast of what the grid CFE would be, and then shifting compute loads back in time during that period, things like feature upgrades or backups,” Michael Terrell, Google’s director of energy (and the author of the 2018 white paper), told me. “Now what we started doing is shifting loads spatially, from one data center to the other. Theoretically you could envision compute following the sun [around the globe], if you took it all the way.”

Adapting demand to supply rather than vice versa — load reduction, shaping, and shifting — is almost always the least expensive way of accommodating variable renewables. There is still a ton of innovation to come in this area. “It's a space where we haven't even really gotten started,” Terrell says.

Energy storage

Storage, currently dominated by lithium-ion batteries, is great for smoothing out the day-to-day supply curve, taking some excess wind from windy hours and saving it for lulls, or saving excess solar from the daytime for nighttime.

However, while batteries are a good balance for renewables’ variability, their hour-to-hour fluctuations, they aren’t as good for balancing its intermittency, the occasional days, weeks, months, even years of unusually low wind or sunlight. Germans call a period like this a Dunkelflaute. It is extremely difficult and expensive to cover one with only batteries to supplement wind and solar.

Clean-firm generation

The third option is “clean firm” generation, i.e., energy sources that can be turned on at will and run for days or weeks on end, but emit no carbon. The two big conventional examples here are hydro and nuclear power, but there isn’t a ton of new hydro available to most buyers and new nuclear (at least in the absence of next-gen nuclear tech) is prohibitively expensive.

There’s also geothermal, which (as I wrote here) is getting a lot of interest and active development. The first bit of clean-firm that Google plans to acquire is geothermal, from a company called Fervo. For now, affordable geothermal is only available in certain areas of the country, but technological advances are close to changing that.

Other clean-firm sources include:

long-duration energy storage, which is technically a form of storage, but competes directly with other clean-firm sources;

advanced nuclear, which has been just over the horizon for years but might finally be getting close;

biomass, some versions of which may qualify as zero-carbon;

power plants running on hydrogen (or hydrogen-based fuels), which are currently being tested in the UK and elsewhere; and

natural gas plants with carbon capture and sequestration (CCS), which are currently both nonexistent and wildly expensive, but may (with the help of a boosted 45Q tax rebate in the Build Back Better bill) become more cost-effective soon.

One reason energy nerds are excited about the 24/7 trend is that it’s going to pull forward in time a bunch of questions (and investment decisions) that were going to face grids trying to reach 100 percent CFE anyway. Perhaps the biggest and most important of those questions is: how far will we be able to get with demand response and batteries? How much clean-firm will we need in the end?

With a bunch of companies and cities competing to reach 24/7 CFE, we’ll find out sooner than we otherwise would have. And the clean-firm sources that are necessary will receive much-needed investment, bringing their costs down and benefiting other decarbonizing grids across the world.

The market products needed to fill the gaps

If companies and cities want to fill in their hourly gaps, they need access to time-stamped CFE. As previously mentioned, current RECs only come in low-resolution form, in chunks of a month or year. They aren’t precise enough to target specific hours.

The answer — simple to propose but devilishly difficult in practice — is to supplement and eventually replace current RECs with some kind of hourly RECs. As it happens, there’s a bunch of work going on to figure out how that would work. If you’re interested, the place to begin exploring is this white paper from M-RETS, a nonprofit organization devoted to the tracking and trading of renewable energy.

Working with Google, M-RETS is pioneering and testing a product called Time-based Energy Attribute Certificates (T-EACs), which are effectively hourly RECs. One monthly REC would be replaced (for a 31-day month) with 744 T-EACs, each representing one hour of the month, each encoding exactly how much CFE was generated in that hour.

For now, in the Midwest, T-EACs are being offered alongside RECs and Google is buying and retiring them. But there’s a long way to go between that test and a fundamental restructuring of REC markets. Says Google:

For T-EACs to be adopted worldwide, we’ll need to standardize the certificates and integrate them into existing tracking systems and carbon accounting programs. Also, grid operators will need to enable customers to access and understand their hourly energy data. That’s why we support policies that mandate publication of grid data, and why we serve on the Advisory Board for EnergyTag, an independent non-profit pioneering a global tracking standard for T-EACs.

This is a big task, which amounts to rebuilding a rather large plane (REC markets) while it is in flight. But the information necessary to do it exists.

That’s phase one of M-RETS’ plan: make hourly RECS available and reliable. Phase two is a little trickier.

Measuring the carbon impact of renewable energy procurement is vexed but vital

Phase two is to integrate carbon information and accounting into T-EACs, to reveal precisely how much carbon was avoided by the clean energy. This information can help buyers prioritize the T-EACs likely to displace the most emissions. It can also allow companies to more precisely track their scope 2 emissions.

For those who don’t remember this bit of jargon: scope 1 emissions are from direct, on-site combustion of fossil fuels; scope 2 are the off-site emissions represented by on-site consumption of electricity; scope 3 (a much broader category) are all the emissions caused by a company’s supply chain and products.

To date, companies have been able to offset their scope 2 emissions with REC purchases. But as we’ve seen, RECs are almost always mismatched to actual hourly consumption, and a company that relies on RECs to offset its scope 2 emissions is likely exaggerating its actual reductions.

Hourly carbon-emissions data attached to T-EACs would allow a company to precisely measure the amount of emissions it reduces through its contracts and thus precisely offset its scope 2 emissions.

There are technical issues around how to properly measure avoided carbon, but we’re going to pass those by for now. There’s a ton of work going on in this area: for companies trying to provide reliable hourly emissions data, see Singularity Energy, electricityMap (formerly Tomorrow), WattTime, and Kevala. In partnership with several energy companies, Kevala recently released a white paper proposing “a methodology for measuring carbon intensity on the electric grid.”

In addition, there are organizations working to develop standards and common definitions, including the aforementioned EnergyTag, “an independent, non-profit, industry-led initiative to define and build a market for hourly electricity certificates that enables energy users to verify the source of their electricity and carbon emissions in real-time,” and LF Energy (the energy division of the Linux Foundation).

The ultimate vision: electricity markets in which each hour of CFE is available as a discrete product, with reliable carbon data attached to it. Within such markets, any buyer — a building, a data center, a city — would be able to know precisely what its real-world carbon footprint is and exactly how much progress it has made in reducing it.

Is 24/7 CFE the next step in carbon commitments … or a distraction?

Let’s be honest: governments ought to be doing this, through policy. The federal government should pass a clean energy standard (or, ahem, a CEPP) targeting a net-zero electricity sector by 2035, like Biden wanted. On some level, all of this voluntary stuff is a suboptimal response to government failure.

Nonetheless, the C&I sector deserves credit for pushing things forward even when governments won’t. It is responsible for enormous amounts of new renewable energy on the grid over the last decade.

Now it is trying to focus attention on filling the gaps left by wind and solar, to achieve full, around-the-clock clean energy. This is a challenge every decarbonizing grid will face eventually. Google et al. are effectively volunteering to explore and chart it in advance.

Nevertheless, there are real questions about whether this is the best climate strategy. A company procuring CFE to raise its own 24/7 CFE score is not necessarily going to procure in a way that maximizes carbon reductions; those two goals rarely overlap perfectly. Critics of the 24/7 trend say that companies ought to be focused on reducing the most carbon possible as quickly as possible, and that hourly T-EACs are in some ways a return to unbundled RECs, with all the same risks that accounting gimmicks will substitute for real emission reductions.

These are complicated disputes that are worth spending some time on. And this post has already gone on for too long! So for now, I will leave it here, with the introduction I promised.

In my next post, I’ll get into the questions around whether 24/7 is the right goal and how it might actually affect emissions. It only gets nerdier from here on out, y’all!