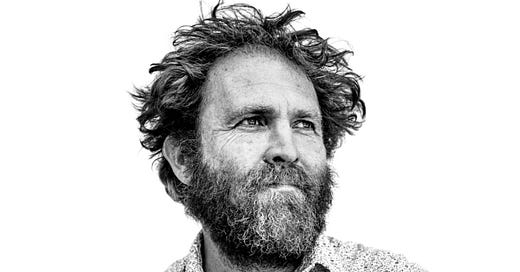

In this episode, Saul Griffith — co-founder of Rewiring America and, more recently, Rewiring Australia — chats about all the things that energy nerds love to chat about.

Text transcript:

David Roberts

If you are a Volts subscriber, you are almost certainly familiar with Saul Griffith. I've been following him and his work for years, and I think I can say without hyperbole that he is the smartest person I have ever met.

An Australian by birth and an MIT PhD by training, he got his start as a tinkerer, inventor, and entrepreneur, responsible for, among other things, the kite-based wind power company Makani and the innovation incubator Otherlab.

A few years ago, alarmed by the lack of progress on climate change, he turned his attention to public advocacy, authoring the book Electrify and co-founding Rewiring America. That organization has, in relatively little time, become incredibly influential among US thought leaders and policy makers. It played a key role in the passage of the Inflation Reduction Act.

In 2021, Griffith and his family moved back to Australia, where he helped found Rewiring Australia, and sure enough, it has already become as or more influential than its American counterpart. As Volties know, I am currently down in Australia. I was scheduled to do a public event with Griffith, so I thought it would be fun to meet up a little beforehand to record a pod.

Neither of us had particularly prepared for said pod, but it will not surprise you to hear that Griffith was nonetheless as fascinating and articulate as always, on subjects ranging from IRA to Australian rooftop solar to green steel. Enjoy.

I won't belabor any further introductions. Saul, thanks for coming.

Saul Griffith

Thanks for joining me in a strange little kissing booth in Sydney's central business district.

David Roberts

Yes, we are. This is the second ever Volts recorded in person. And just so the audience knows, this came together at the last minute and neither of us have prepared at all. So we're all just freestyling here and we're just going to have a conversation. So, Saul, let's start with you were intimately involved in the sausage making of IRA. Why don't you just start with telling us a little bit about how on earth someone like you ended up in the halls of DC with the ear of lawmakers. What's the origin story of this?

Saul Griffith

The romantic origin story is just before I married my wife and I think it was 2007, I said, if the world hasn't made sufficient progress on climate change by 2020, can I become an ecoterrorist? To which, it was so far in the future, she said yes.

David Roberts

Surely, well, by then, surely.

Saul Griffith

And then 2019 came around and I said, remember that you made that promise to me. And she said, yes, but we didn't have two children, so you're not allowed to do that. And she sort of actually first planted the idea in my head. You're always complaining that the hardest thing to do in energy technology is the regulatory stack. So why don't you focus on regulatory and policy for a while? I give you leave. We can afford it. See what you can do. Right about then, I was having another conversation with a guy called Alex Laskey. He was a founder of Opower.

He wanted to talk to me about heat pumps. We were working on some new heat pump technologies and the conversation spiraled out of control and we said, well, working on heat pumps is good, but these Democrats keep saying climate change. So this is in the primaries. Every time any of them say climate change, they wince a little bit and try to shy away from what you would do. So we started Rewiring America. We booked a few tickets to DC, we took a few trips to DC and we thought that we were going to be an advocacy organization, trying to help Democrats talk positively about what the energy transition could be, how we could save money, how our health outcomes could improve, how we could change local community economics.

So we were trundling along with that effort, working with all of the presidential candidates at the time, and I can retroactively say I loved them all exactly equally.

David Roberts

Didn't you love Jay Inslee just a slight bit more, though?

Saul Griffith

Understanding where you're from, I know why you say that. And I did love Jay Inslee just a little bit more and just a little bit more than Jay Inslee I also loved Elizabeth Warren.

David Roberts

Yes, RIP, I know she's still alive.

Saul Griffith

I'm sure she's, well, maybe not politically.

David Roberts

But RIP to her.

Saul Griffith

I have a habit of judging people by their staff and it was so obvious to me that her staff loved her and believed in the mission and it was extraordinary to behold. So we were doing that and then the election was won and it became — we'd hired, Alex and I are probably both ADHD to an extreme, so we hired a competent adult to run the organization Rewiring America, a guy called Ari Matusiak. He'd actually worked in the White House under Biden, worked on similarly complex legislation, the American Healthcare Act. So we knew a bunch of people on the climate team going in and we were worried, so we went to talk because really what we wanted to prosecute was the case for — electrification of everything is really the only pathway to eliminate the majority emissions and secondly, that any spending should equally or even maybe bias more a focus on the demand side.

And what I mean by the demand side, the places where we use energy. So households, small businesses. Part of that was because there was still the idea that you just decarbonize the grid and they were thinking about clean electrification standards. But if you just do that, you don't also electrify the cars and electrify the homes and eliminate all their stuff. So I was worried that we were going to have insufficient climate policy because of that. So we did a lot of work working on the demand side. The early days, we didn't know whether the Democrats were going to take on the filibuster and whether they were going to go big, so they're — sigh yes.

So there was three or four or five months where we thought there was going to be regulation and legislation and I think people were thinking about regulating and legislating the grid and electrification grid. When that fell through, let's say that ears were a lot more receptive to what we were trying to propose, which was this demand side electrification. We got extremely lucky a few times he's told this story himself, so hopefully I'm not speaking out of school, but Senator Martin Heinrich of New Mexico, his dad was a lineman, so familiar with electricity, the only senator with an engineering training. He had heard not to belittle your podcast, but he had heard another fabulous podcast with me and Ezra Klein when he was driving across the country with COVID and he cold emailed us at Rewiring America, and we actually let the email sit in our inbox for a few weeks.

But eventually he became a champion and, in fact, helped us. I got up at 02:00 a.m — so in the middle of all this, we were going to move to Washington. We had booked an AirBnB. My parents were going to come and live in Washington. My kids were going to do homeschooling on the Mall, and I was going to do six months of door to door knocking, Republicans and Democrats selling the abundance agenda of climate solutions. And three days before we left, San Francisco went into COVID lockdown. So we persisted in San Francisco for another six or nine months.

Then when San Francisco shut down the schools for another year, we said, well, we know the schools are open Australia. So we ripped off the Band Aid and got the hell out of Dodge. Anyway, that meant that Rewiring America Now is doing a lot of this work internationally. We were still a tiny team. And I got up at 02:00 a.m. one night to talk to the Democratic Senate Caucus, basically a tutorial of how the U.S. Energy system works, why you have to electrify, which there is precedent for. During the oil crisis in the 70s, there was a book produced by Georgetown University which in the opening paragraph in the book is like, this book will show the competent person in 1 hour or less how the U.S. energy economy works. So I was trying to do that.

David Roberts

In an hour or less.

Saul Griffith

In an hour or less with the Sankey diagrams. Here it is. And we made the case for demand-side electrification. We were lucky in a million ways. We got involved with a large coalition of people who were working on pieces of the bill. People, you know, like Leah Stokes, Jesse Jenkins. And we rolled up our sleeves, sort of sensing that unless people outside of government put as many ideas down as possible, it would be underwhelming.

David Roberts

A lot of my audience, I think, is quite familiar with IRA at this point. But maybe tell us a little bit about the sausage making. What is your impression of how a bill becomes a law, as they say? Was it more or less irrational than you expected? Were there more or fewer sort of sane people involved who had their head on straight?

Saul Griffith

I think there was a huge number of people very well-meaning and diligent and working hard. I think there were a lot of people who would fit those descriptions, but you might say had 30 and 40 or 50-year-old ideas that they wouldn't let go of. I was surprised at how much we were facing opposition from the gas industry in many different forms on all aspects of the bill, really. I was politically naive. I was a Silicon Valley entrepreneur for 20 years. I never really cared for politics, so I thought that legislation was written by politicians.

But I had an unbelievable awakening that it's actually written by lobbyists. So we became basically a lobbying organization and worked with a few others. So it was all a giant learning journey for me, for all of us.

David Roberts

My impression is that the sort of — because originally, Build Back Better was this massively sprawling, it had health care, it had childcare voting reform, et cetera, et cetera, et cetera, and everything got winnowed away, basically, down to just the climate stuff —

Saul Griffith

Oh, you know, I saw a little bit further back even than that. AOC's staff contacted me when it was the Green New Deal. Can you help us come up with some climate policy? I think they gave me four weeks, and then they announced something two weeks before I'd been able to do much. But yeah, it went from — I think the transition from Green New Deal to Build Back Better was just as —

David Roberts

Winnowed and winnowed and winnowed and went, shrunk shrunk shrunk shrunk. But my impression was that in the details, a lot of that sort of original wonky thinking and a lot of that original legislative writing more or less survived. Like for all the drama, Manchin took out the beloved clean energy, whatever the I can never remember the name of the damn program, but the one sort of stick, right, the one stick left in IRA. But otherwise it seems like in the details, nobody really mucked around too much with what the wonks originally put on paper. Is that your impression, too?

Saul Griffith

Pretty much. The wonks came out strong. It felt to me like a special process. Like this was the first time that engineers and physicists were in the drafting room.

David Roberts

And modelers, and it seemed like I was shocked and surprised, like I was anticipating that Manchin, because of all the fits he was throwing, would have policy opinions, and if he came and could be persuaded, he would have policy asks. But instead he just woke up one morning is like, sure, whatever, this thing that's sitting here is fine. So he ended up actually not messing with it. Maybe to his subsequent chagrin.

Saul Griffith

The rumor I heard from people who were in those negotiations were like, normally this is fairly easy. You have an obstructionist senator. You ask them how many schools and highways they want.

David Roberts

Right.

Saul Griffith

You give them schools and highways and anyway, rumor has it that there was no negotiating.

David Roberts

Yeah. It was unclear what he wanted, and then it was unclear why he changed his mind.

Saul Griffith

Yeah, I don't know exactly why, but I do remember we made a presentation called electrification is anti-inflationary, and it's an extraordinary graph. You can look at the household cost of energy in the US for all of the energy you use. So your petrol, your gasoline sorry, I'm living in Australia now, so I have to translate all the cost of your gasoline, your diesel, your propane, your network gas, your electricity, and you can see it, that chart from 1980 through to 2020 is upwards to the right at roughly the price of inflation. That shouldn't surprise you because the energy is a core part of the consumer price index.

David Roberts

Yes, a big part of the inflation we experienced. And that Manchin claimed to want to do something right.

Saul Griffith

So we then showed a chart that here it is, up into the right. If you electrified everything in an American household, this is the amazing thing. When you buy solar cells and put them on your roof, you're paying for 20 years of energy up front, and so then you're paying a fixed interest payment. So you've got no — you've inflation-proofed your energy inputs. You've bought — you're depreciating your electric vehicle, you're depreciating the electric stove, you're depreciating the electric water heater. And so in fact, your cost of energy stays dead flat at your price of finance. And that's a pretty profound insight that this energy transition is the substitution of finance for fuel.

David Roberts

Yes, I've been trying to carry that message here to Australia. This is true at the micro level, it's true at the household level, and it's true at the —

Saul Griffith

True at the macro level, too. I don't think economists have grappled with this yet. It's really amazing.

David Roberts

And the implications are, you know, you follow that string for a while, it is transformative. So then let's just briefly wrapping up on IRA. Obviously, it had to go through budget reconciliation. So obviously the whole regulatory and standards side got chopped off. So just say a little bit about what you think it's missing, where you think it falls short, what you would have liked to see more of in it had there been a more sane policy process and vehicle.

Saul Griffith

Industry would have more certainty if there was regulatory teeth.

David Roberts

Right.

Saul Griffith

Some sticks. And industry would make investments with more certainty. Were there — Norway, ICE vehicles in 2025. Victoria just announced they're going to stop gas in new built homes. So there's these precedents that sort of certainty would certainly help, and I would have loved to have seen that. I remember actually in talking to that Senate caucus pointing out that really only three fifths of the US energy economy was being addressed by the bill. There was actually a huge amount for vehicles and transport, a huge amount for households, but very little for the commercial sector and very, very little for industry apart from a few advanced manufacturing things.

And so I think Jesse Jenkins is a bit optimistic when he predicts maybe it'll get 40% emissions reductions. I think it probably gets 25. I'll have that conversation with him soon.

David Roberts

That's quite a delta.

Saul Griffith

I hope he's right. That would be great. But, I think they missed large pieces of the economy, didn't have regulatory teeth, but quite honestly, in retrospect, it was the only thing it could be, and probably was more by accident than anyone's grand plan kind of genius. Because I think it gets some Republican proofness through being all incentive-based. I still remember the moment where we're a year into the process and everyone's like, "Oh, pens down, tear up everything you've done. Now it's a tax code hack." It's a tax code hack.

David Roberts

Much like virtually all of US policy, federal policy for the last whatever decade or two.

Saul Griffith

Yeah, but I think there's something really — I now am prone to saying to the Australian government, "You're not serious unless you're rewriting the tax code." And that's the evidence of whether you are going to fix climate policy.

David Roberts

So, Biden is now out saying, and he has his people out, "This is Bidenomics," by which they are saying the era of sort of free trade, free market neoliberalism is over. To what extent do you think that is sort of a retroactive wrapper to put around IRA? And to what extent do you think that's really sunk in in DC? How dead is neoliberalism in DC?

Saul Griffith

This is where the podcast goes off the rails. I don't remember most of the people doing the modeling, wrestling with international trade in the work. So, I think it is a little bit retrospective by my interpretation, but I think it's a very honest assessment that we are not operating in anything remotely like a free market. China is producing 90 plus percent of the world's solar cells with 90% of them containing technology that was invented in Australia, about a mile from where we're sitting, or 1.8 km. China is producing the overwhelming majority of the batteries. The Australian steel industry, which I stay in touch with because my first degree was in metallurgy, my first job was in a rod mill, is extremely aware that you could not make the tower pieces for a wind turbine. That's maybe the simplest thing in renewable energy is to make a giant steel tube. But the best estimates are that China is underwriting those 25% to 40%. So unless you figure out some way to rebalance that, then your economy is not going to make the transition very elegantly.

David Roberts

It takes two to neoliberalism.

Saul Griffith

So that piece of neoliberalism is maybe dead, but there's another piece of neoliberalism that is alive and well, which you might call the porous borders for international capital. Headline in New Zealand last week is that BlackRock is huge amounts of money going into New Zealand's regulated electricity industry to buy all the offshore wind turbines. So in regulated monopolies around the world, you get a guaranteed profit margin. Australia gives a guaranteed profit margin of 9% to transmission and network companies, which is why most of our transmission network companies are owned by Singapore and China. So, I worry that if countries aren't aware of that, all of the profit, all the margins are going to leak away from these countries. If really you can generate your own energy domestically. So, Australia's economy is about a 10th the size of the US. But we import 40-50 billion dollars a year in oil. We import basically all of our oil. We have abundant sunshine driving an electric car in Australia on rooftop solar costs you about two cents a mile. It's about twenty-eight cents a mile to drive it on gasoline or diesel. So we could totally have this $40 billion a year windfall driving Australian electric cars, but we may not choose to do that well.

David Roberts

You'd prefer to keep that in Australia, obviously.

Saul Griffith

I think you would like to keep as much of that in Australia as possible. I think the fact that we've sold off our gas networks and electricity networks to overseas interests in a bunch of places is a bit of a disaster that will hamper this transition, that won't allow us to build a lowest cost energy system. Because the rules that we wrote 20 years ago that were a good idea in the fit of neoliberalism at the turn of the century are not a good idea now. So, I think neoliberalism, it's got some wins and losses, hopefully a few more losses.

David Roberts

Half dead.

Saul Griffith

Half dead, it'll zombie along. You remarked to me yesterday on the phone that you smell a bit more neoliberalism in Australia than you thought you might. That's been my experience in returning home.

David Roberts

Interesting. Well, let's talk about speaking of which. What's your impression of the international effect of IRA? The effect of IRA on the international conversation in other countries.

Saul Griffith

It's extraordinary. And this is a win that America should take and the Biden administration should loudly pronounce as their victory. Without IRA, the world wouldn't have done anything particularly significant. Because of IRA, Australia is now engaged in a conversation with itself and amidst government of what is our response to the IRA.

David Roberts

Every government, I think, is.

Saul Griffith

Yep, we now have Rewiring Australia, Rewiring New Zealand. In both places, we're trying to look at policy that you would write in those contexts. That goes further than the IRA. I think Jesse and my argument of 25-40% aside, we really need 60 or 75%. And that's made obvious by all the fires we're seeing around the world and the heat waves. And so we need the IRA to become better versions of itself as it's written in every new legislative. You know, it might sound strange to you, but I'm doing a lot of work in New Zealand. They're four weeks out from a transformative election.

They could set very interesting precedents for ways to use their carbon credit system to help electrify and decarbonize. They could set precedents in household financing. The IRA was regressive because it was a tax code hack. You had to earn enough money to be able to get the rebate for the electric car. The Australian government has a tradition of more progressive policy. I think we could do IRAs that reach all demographics and do a much better job for low middle income households. I think the world has to take every one of those opportunities to get ambition to beget more ambition. It's our only real climate hope.

David Roberts

I, relevant, the other day was in a small roundtable, including, among other people, Australian Energy Minister Chris Bowen. And he said that in his estimation, the IRA was the single most important thing that's ever been done for climate, including the Paris Agreement. He thinks it's bigger than the Paris Agreement in terms of the international reverberations, which may or may not be a bit of exaggeration, but I think it's testament to the transformative effect it's having on other countries' thinking.

Saul Griffith

I think he's right. I wouldn't have thought that he would think that. I'm glad he's thinking that and I think it's true. The IRA has put everyone on notice a little bit.

David Roberts

Yeah. So, let's talk about Australia, then. We're here in Australia, you're working with Rewiring Australia, and from my sort of discussions around with various people here in Australia, my sense is that there's not a lot of "should we or shouldn't we" anymore. It's all "how should we?" Right? It's all "what should we do?" It seems like, obviously, I'm not talking to the Conservatives here, but at least among the ruling coalition, it seems like they want to do something big. But it also seems like, as you say, there's this lingering "we can't just spend a bunch of money, we can't keep up with the US on sheer spending, we need something else."

There's this lingering sort of like, "we've got to be revenue neutral, we've got to balance our budget." All this the lingering hold of the aforementioned neoliberalism. So what's your sense of how wide the range of practical possibilities is here? Do you think there's an appetite for going as big as you want to go?

Saul Griffith

I know there is, and I'm encouraged by conversations I've had with the coalition government. I'm even more encouraged by some of the conversations I have with the independents that made an incredible showing at the last election.

David Roberts

The Teals. See my previous podcast.

Saul Griffith

Yeah, they don't have a lot of political power, but they're having some influence, which is good, but I see there's a lot of appetite. The challenge is we have a very strange economy. Two thirds of our emissions don't even count on us.

David Roberts

Right. Scope three.

Saul Griffith

Yeah. So we make coal for the rest of the world and have some liquid natural gas and none of that counts on us. In fact, 10% of the Australian emissions that do count us is using fossil fuels to get those fossil fuels to international markets. Because of that, there's the fear that if we lose the prevailing fear that we lose fossil fuels and what do we replace that with? Is driving a lot of misinformation. Two or three months ago, I went with a Smart Energy Council and a bunch of people variously involved in renewables and electrification to Parliament House, and there were 40 of us and everyone was self-congratulatory, like, "Isn't this great?"

And I was giving the motivational speech and I was like, "you know that there's 80 gas industry people here every day. This is the first time we've ever showed up with 40 people," and that's what we're facing. A manifestation of that is in the last budget, we got a billion dollars in the bill for electrification. They got $2 billion for hydrogen. Hydrogen production in Australia can only increase the retail price of electricity for Australians because they have to take the lowest price electricity to produce hydrogen, otherwise it won't make it economic. And we don't need hydrogen to decarbonize any major portion of the Australian economy, so that's really just to do exports.

David Roberts

There's a lot of talk about Australia becoming a hydrogen superpower. So we can talk about that in a second.

Saul Griffith

Yeah. So the genius of the Inflation Reduction Act is the majority of the incentives went to consumers. That's good politics. I'm going to help you have the shiny things that will help you go green, get to zero emissions and lower your cost of energy. The majority of the conversation here is, how do we do handouts to largely foreign-owned industry so that we can maintain their jobs, but the jobs we get aren't that great and the profits are foreign-owned. I think 85% of our coal and a huge amount of our iron ore industries are foreign-owned at this point.

David Roberts

Good grief.

Saul Griffith

So I think we need to win the argument in Australia that do make it good politics. Help single mothers in the outskirts of Sydney or Melbourne buy an electric car so they can save $3,000 a year on their horrific commute. That would be good politics and the fastest way for us to address domestic economy emissions reductions, the government's first two pieces of climate policy my apologies, Chris, I think are going to be a bit troubling for the government. So one was the safeguard mechanism, which is an incredibly complicated, arcane way for industry to basically buy industry credits, unclear that that will deliver any emissions reductions this decade.

The second piece was a program called Rewiring The Nation, which was to connect the renewable energy zones, which were picked politically, not necessarily for energy cost reasons, to connect them with big transmission lines. So it'll take five plus years to get those transmission lines in the ground. You're going to piss off every farmer and everyone in a small town who has to look at the wires, and it'll take another couple of years for the solar and the wind to connect up to them, so it will not deliver any emissions reductions by our critical 2030 date. So I think it's more reasonable to say, look, the thing you can do now, rooftop solar, we could power 60 plus percent of all of our household energy uses, including our cars on our rooftops here.

It's the cheapest electricity in the world as Australian rooftop solar, three to four cents after financing. And you could do all of those emissions reductions very, very quickly, because pretty much all the industries are, if not at scale, getting close to scale. Electric vehicles, electric heat pumps, induction cooktops, household batteries.

David Roberts

Let's talk about rooftop solar for a second. I've said this before, but the sort of freakish success of Australian rooftop solar seems oddly little discussed here in the sort of policy and energy discussions I'm having. And I don't know why it's not trumpeted more. So maybe just tell us a little bit about why is it so cheap? And something I hear, I mean, I've heard a lot of confident, very opposing opinions. Some people will say it's creating this huge Duck curve. There's this huge swamp of solar during the day. We're having to curtail it now. We've already like, building more is basically pointless at this point until we have more firming and more transmission.

And then other people say, oh no, there's plenty of runway, there's plenty more rooftops, there's plenty more we could do with rooftop solar. So maybe just say a little bit about why it's so damn cheap and how much headroom you think there is.

Saul Griffith

I tried to do a column for the New York Times. They actually published it on why Australian rooftop is so cheap. They flubbed it. They didn't want me to say that American rooftop solar is more expensive than the grid, which it is, because they didn't want to deter people from purchasing rooftop solar. So much for integrity in journalism. So I actually interviewed a whole bunch of people who were very early in the 1990s, early 2000s Australian solar industry, and I got roughly ten different answers for why. Some was political luck. We got John Howard traded sort of a yes to doing some rooftop solar stuff because he was going to throw Australia under the bus at Kyoto. And some academics and some smart early industry people took advantage of that.

Part of it is we created a certification and training program that took a lot of the liability away from what you'd call contractors; we call them tradies. That took a big chunk of the cost out. And then Australians abhor — Americans like to think they're small government, but we really want to be small government and low bureaucracy here. On average, it takes three months to get a permit to put solar on a rooftop in the US. 50% of sales are canceled in that three months. Because you get cold feet, you have to go through what's called an ASJ, an Authority Having Jurisdiction.

They have different rules in every single state. I think there are 11,000 ASJs in the US. In Australia, you get the permit over the phone in 24 hours and the tradie is on your roof 24 hours later.

David Roberts

Wow.

Saul Griffith

I keep trying to convince my colleagues at Rewiring America we should run a "Get the Government off My Roof" campaign in Texas because there's no reason. In fact, an Australian solar installer is paid about 10% in real dollars, more than an average American solar installer.

David Roberts

Are those good jobs here? Because in the US they have a pretty bad reputation.

Saul Griffith

They're not fabulous jobs, they're not terrible jobs, they are definitely hardworking trade jobs.

David Roberts

And so what's the headroom one out of three?

Saul Griffith

Australia 35%. I think California just touched 2% penetration.

David Roberts

And already California is panicking and trying to change the rules and saying we have too much blah, blah, blah.

Saul Griffith

Well, I now work with what they call here DNSPs again. In a fit of neoliberalism, in the 1990s, we introduced market reform. We split our utility monopolies into four functions: transmission, distribution, retail, and generation. The price of electricity went up because now you had four times the overhead. But the good news is that the DNSPs sort of see the opportunity. So they control the local poles and wires. When you talk to the CEOs of the DNSPs, they understand that you need to deliver 300% of the electricity over those local poles and wires to accommodate the electric cars and the electric cooktops and the electric water heaters.

So their business is going to grow. They understand that even if you saturate Australian rooftops, which might saturate at 75 or 80% penetration with big systems, 8 kW, their business still grows. And so the natural partnership for a lowest cost energy Australia, is a partnership between the city, the householder, and the DNSP. And when you talk to those DNSPs, they understand that the batteries are coming, they understand that the electric cars are coming, they understand that all the demand response systems are coming and that that will solve this problem. But if you talk to a generator, they don't think about batteries, then electric cars is the storage and mopping all this up.

If you talk to the retailer, they're a bit scared that they might get cut out of this because the householder can do it without them. And if you talk to the transmission companies, they're a regulated monopoly that gets a guaranteed return on investment for building wires, whether or not you like it. So none of them are particularly interested in the truth, shall we say. So I think that's why the answers vary greatly.

David Roberts

And so you think you can go from 35% to 70 or 80% of rooftop solar.

Saul Griffith

With 75% penetration in Australia of 8 kW systems. We would produce 60% of all electricity required for 11 million households with all electric vehicles, all electric appliances.

David Roberts

And you think you can balance that out and firm that just with household EVs, household batteries, household demand response?

Saul Griffith

Not entirely. And so people often hear me and they think, oh, he's the off-grid guy, but I'm not. You need other renewables in the mix. It is handy that Australia has some hydro. We're doing a big pumped hydro project. It's over budget and behind schedule, but that's true of all big infrastructure. Nevertheless, we need that. We need wind, which counter correlates with solar and will fill the gaps in in winter and really, Australia's best strategy is oversupply. So you don't install — California has rules that make you install sort of the summertime amount of solar to just do your electric appliances in your house.

Solar in Australia is so cheap that you should install enough solar so that you've got enough to run your house and your cars in the winter, which is a 12 or 15 kilowatt system. And it's much cheaper to have 200% of three or four cent generation cost solar than a huge amount of batteries, all these other things. So Australia can actually quite easily do this, curiously, with an oversupply strategy and good energy management. And, yes, you have to have a mix of renewables, but everyone agrees and expects that. And we're doing offshore wind and onshore wind and all the things.

David Roberts

Let's talk about the other huge topic that is extremely front of mind for Australian politicians, which is Australia's extraordinary amount of critical minerals that are going to be needed for the energy transition, and batteries and solar panels, et cetera. How much does it have? What does it currently do with them and what ought it to do with them?

Saul Griffith

We have the first, second, third or fourth largest known ore bodies in the world for all of the above materials. Cobalt, nickel, iron, aluminium, silicon, lithium, copper, tin, which are all the things you need. We sold 55% of the world's lithium last year. So we can easily be a much, much more dynamic, much, much more profitable economy, selling those minerals and metals to the world. You don't even need the super exotic stuff like neodymium. If we just processed our iron ore domestically into steel here, which will be a good idea because we will have the cheapest renewables in the world, it will be hard for someone else.

If you make hydrogen in Australia from our sunshine, it's going to be, by the time it's in China, five times more expensive than our sunshine. Half of the cost of steel making is the energy that goes into it. So we have this fundamental advantage in the new economy that we'll be able to make all of these metals. We only process 1% of our iron ore into steel domestically at the moment. If we processed 100%, it would be more than a $1 trillion industry that is ten times larger than all of our fossil fuel industries. So even if we don't do the exotic stuff like lithium and copper and nickel and tin and all the other things just on iron and aluminium, we can make hay. And it's a better export economy than the fossil fuel economy that we have.

David Roberts

You think it makes more sense, rather than using the wind and sunshine to make hydrogen, exporting the hydrogen to other steel making countries where they will make green steel, you think it makes more sense to just make the green steel here? And do you have the infrastructure and skills? And how much would it take to revive that industry?

Saul Griffith

Well, this is a bit of a question about neoliberalism. My father was the first person in the history of his family to get a degree. He was paid by the Australian wool industry to become an expert in wool making when that was our major export. I had a full paid ticket through university, paid for by the Australian steel industry when that was what we were going to do. So we used to, as a country, invest and they were fully funded, free educations for both of us. We used to understand that you invested in the people to do those things and then they would build the industries.

We stopped really doing that in the 2000s. If we can find the courage to do it again, we can do this. And we still do have enough muscle memory in Australia. We are losing it rapidly, but we could still do it. I think it's just a matter of political appetite.

David Roberts

So how do you make an argument? I mean, what do you say to a politician who says, sure, OK, yes, let's do more processing of our critical minerals, let's move farther up the value chain of critical minerals. Sure, let's process our iron ore, let's even make steel and then let's also continue exporting met coal because there's a huge appetite for met coal and it's good for our economy. What is the freestanding argument for seizing fossil fuel production, is there an argument?

Either the high-met process in Scandinavia or the Boston Metals process or one of these things will eliminate met coal within the next decade?

You think so?

Saul Griffith

So it's existential and a little bit to your last point, but also to this question: The energy cost of coal into steel making is about a half a cent a kilowatt hour equivalent in heat. The energy cost of natural gas in steel making is about one cent per kilowatt hour in heat. The Australian stretch goal for hydrogen is $2 a kilogram, which is copied from America's $1 a kilogram, that's six or seven cents a kilowatt hour at the electrolyzer that's before you've transported or shipped it, it'll be 12 cents in any reasonable optimistic estimation. So you're not going to make steel with a lot of hydrogen because you're going to make steel cost five or six times as much.

So I think we've just got to get with the program and invest in those things. They are the critical industries for our next century. We got to invest in them. We have all the American problems. We gave away all of industry between 1980 and now. With my metallurgical degree, I went off to MIT because there were no jobs in metallurgy in the 1990s, because we were just starting the neoliberal ideal.

David Roberts

So talk about then this ties into very closely the export economy. Talk a little bit about Australia's relationship with the sort of Asia Pacific region like Japan, for example. Japan is an island not blessed with a lot of domestic energy supply resources. It wants to, I think, has some illusions that it's going to become that it's going to sort of import a bunch of hydrogen fuels from Australia to run its economy on. What is the sort of political valence of these other countries? What do they want and what do you think would make more sense to give them?

Saul Griffith

We've had long standing relationships with Japan. My son is in high school in Australia. He's much more likely to learn Japanese in Australia than you are Spanish. Germany and Japan both lost World War II because they didn't have a domestic supply of liquid fuels. Germany was developing hydrogen for the V-2 bombers, and the V-2 bombers were powered with hydrogen. They were using coal gasification.

David Roberts

Yeah, right.

Saul Griffith

We had seven years of both of those countries believing that their path to energy independence was through hydrogen. And that explains probably more than anything else, why the last two sets of automakers in the world to really commit to electrification are the Germans and the Japanese. As giant trading partners of ours they're driving our hydrogen fever. But refer to the previous conversation. It's just a very expensive way to do everything. We will do some hydrogen, and you need it for ammonia and you might need it for steel making, but only the redox component, not for the energy component.

Redox meaning the reduction reaction, getting rid of the oxides. But we are still addicted to this idea that we're going to sell them gobsmacking amounts of hydrogen.

David Roberts

Well, they're addicted to the idea too, are they not?

Saul Griffith

They are also addicted to the idea, and I think there's a reckoning there.

David Roberts

Interesting. So what is Japan's answer? Because it seems like one of these really difficult equations in the transition. What does Japan do?

Saul Griffith

Japan will almost certainly turn its nuclear power back on, or it will figure out a better relationship with its geothermal resources. It also has extremely good offshore wind, and they're a manufacturing and precision engineering powerhouse. That's not going away anytime soon. The question is, can they survive the 20 year head start they gave to China on electric vehicles? So that's my concern for Japan.

David Roberts

Interesting.

Saul Griffith

Toyota and the Japanese companies drive so much of the economy.

David Roberts

So turning back to Australia, you — obviously play a big role in your sort of head, your scheme is played by EVs, playing a role as storage. Let's just talk briefly about vehicle-to-grid (V2G). Because this is another thing: When you sort of toss it out in public, you get a lot of extremely confident, extremely mixed opinions about its potential. It's realistic, how realistic it is, whether consumers will put up with it, whether cars are available when you need them, et cetera, et cetera. How bullish are you on that, on V2G?

Saul Griffith

I think there will be some V2G. I think it will take longer than we think and I think we'll give up a smaller portion of the battery to the grid than people expect. And I don't think that's really the relevant question. The only thing that matters is are the cars going to be plugged in when the sun is shining and the wind is blowing? So really, it's about a profusion of vehicle charging infrastructure. So that is absolutely critical and we have to do that. And you can make the numbers work without intoning huge amounts of V2G. I think V2G will happen.

The battery packs are just getting bigger. Unfortunately, Australia, I would have hoped — speaking of Japan, Japan has Kei cars. Do you know, K-E-I? They're fabulous.

David Roberts

They've gone viral on Twitter several times recently.

Saul Griffith

Yeah. I was hoping Australia would — we could manufacture cars in Australia again if we'd made Kei cars, because we'd only compete with the Japanese. If we wanted to make trucks or utes, we can't compete. And Australia looks like we're going to go down the giant ute path. I own a Rivian in the US, a giant 172 kilowatt hour battery on four wheels. I will use in an all electric household, driving two cars, the average amount Australians, 37 kilowatt hours a day. So the battery in that Rivian is five days. The battery in the second Rivian is another five days.

So, I've got ten days of energy from my household in my two utes. I kind of hope for the planet that that's not how we solve climate change. But you can tell that story now where I think it's still a political sore point in Australia. What are we going to do with our utes? I mean, it's a religion here.

David Roberts

What, the utes?

Saul Griffith

Yeah. And a lot of 23-year-olds own 70 - their best asset is a $70'000 or $90,000 ute and they're probably in debt in every other way. So it became strangely central to the Australian ethos in the last 30 years while I was away. I was surprised when I returned.

David Roberts

Yeah. What is going on with the obsession with big trucks? Do you think Australia will ever — speaking of moving up the value chain, you go all the way up from critical minerals, you get to battery cells, you get to batteries, you get to EVs, and then you get to battery recycling. How far up that chain can and should Australia go all the way?

Saul Griffith

I think we are fine if we are the foundry of the world, if all we do is make the metals turn bauxite into aluminium, turn iron ore into steel, turn lithium brines into lithium. Would I like us to go further up the value chain? Yes. My father was employed in going up the value chain in the textile industry. He made the spinnaker that defeated America in the America's Cup in the 1980s. We know we can do those things. Very hard to imagine how we do it in Australia. Our prevailing wage is ten times higher than all of our neighbors.

David Roberts

Oh, really?

Saul Griffith

I mean, our neighbors are Indonesia, Asia, Southeast Asia, Sri Lanka. We can only do it with extraordinary amounts of automation and probably things like border carbon adjustment mechanisms. Something that was announced today in Australia with the idea that — your mate Chris Bowen. But it's pretty hard to imagine that we'll do these things otherwise. We do have a solar manufacturer here. They make incredibly high-quality cells. They're 25% more expensive than the Chinese ones. They are better, probably. They come with a better warranty. But we are a Walmart bug and hunting country like yours, which is not called Walmart, it's called Bunnings here.

So I worry we could easily make electric cars. Again, there's no reason not to do any of these things. I suspect in the wind turbine space, we'll make towers and maybe the floating platforms. We won't make the nacelles. Denmark and Korea have and America have a 20-30 year head start on that. We could make the blades, but we probably won't. But it doesn't matter if we were in the best use of our extraordinary abundance of very cheap renewables, if we are the world's foundry, we're in great shape. And to put that in perspective, Australia could supply all of the energy for our domestic economy and process all of our metals with about a quarter of 1% of its land area dedicated to renewables.

America would need 2% to do the same and China would need up north of 10%.

David Roberts

Interesting.

Saul Griffith

So really, only if Australia steps up to be the foundry of the world does the whole world get there.

David Roberts

Yeah. And what a better moral position to be in than the one you're in currently, which is the entire health and success of your economy is contingent on the failure of humanity to solve its biggest problem is that moral dilemma sinking in to the public.

Saul Griffith

The public that I hang out with? That's not the public, it's the public you hang out with in America. I think in Australia and America, 2% to 5% of people worry about the moral dilemma. What I don't understand, and I was reflecting upon this, for whatever reason you sparked this thought, we still have never had any important global politician in command of a reasonably sized economy, stand up and say, solving climate change is going to be good for us. Like, if you think about all of Biden's —

David Roberts

Biden says, jobs, jobs, jobs. When I think climate, I think jobs. That's his shtick, right?

Saul Griffith

Yeah. But no one ever stood up there , and Winston Churchill'd we'll fight them on the beaches, we'll succeed. I'll improve the air quality of your children. I'll do all of the things right. Biden's message is very simple: Jobs, jobs, jobs. It would be within reason and not exaggerating for Prime Minister Albanese to stand up and say, I have a vision for the country. Here's the 50-year vision. We will be the world's foundry. We will increase our exports by five x. We will own more of them because it's on crown land, the majority of the ore.

We will lower energy costs because of our abundant renewables. And I think that would go along in a similarly important historical moment to the IRA. I think if Australia did that, that would also get a whole bunch of countries to be like, oh, because of our rooftop solar, we're ten years ahead of everyone else on the cost curves.

David Roberts

Yeah. And it's so much more inspiring than being a hydrogen superpower, because for the average citizen who gives a f —

Saul Griffith

No, Australians don't think we're a superpower in anything. I mean, we're a superpower at women's soccer this week.

David Roberts

Go Matildas.

Saul Griffith

Go Matildas. But — I don't think truly identify with that superpower narrative. I understand the political origins of that narrative. That's what environmental organizations had to sell ten years ago to a very conservative government as the reason to do anything in climate.

David Roberts

Running out of time here. There was one other subject I wanted to talk to you about, which is a very beloved subject of yours and of Rewirings, which is anytime you bring up let's electrify households to average folk, what you hear is, it's too expensive. I can't afford solar on my roof, I can't afford a heat pump. It's so much more than a gas boiler. EVs are so much more expensive. These are all toys for rich people. There's a real populist, faux populist, call it pushback to all this stuff. And your response to this in various and sundry ways has to do with financing. So in the Australian context —

Saul Griffith

Which brings us to neoliberalism.

David Roberts

Once again, we're back to our old friend neoliberalism. Let's talk about what would it look like to finance Australians shift.

Saul Griffith

So the perception of those things in America is a little bit true.

David Roberts

People are not making it up.

Saul Griffith

Yeah, your fossil fuels are cheaper, your bureaucracy is heavier and incurs more soft costs. And because it was a tax code hack, the IRA, it's regressive. So you have to be a rich household to make enough money to earn the tax credits. There's a few in the margin.

David Roberts

Some are refundable, right?

Saul Griffith

I mean, some are refundable and Rewiring America, and others are trying to figure out creative ways to actually package these up so you can deliver it to low-income households in smarter ways. But my true hope for Australia is because we have a stronger tradition on the labor side, on the left side of politics and of broad social policy, including Medicare and Medicaid and the Australian public health system, which is a little teetering right now but has been extremely strong for a long time. I think we are capable of big — and we had a higher education contribution scheme here. It's a little out of fashion right at the present moment because the rules of it changed a little bit under the neoliberals.

This is how you finance your education. But we have in the past written global, precedent-setting social policies that were really around debt and about how and who people pay for things. And so I think there's an extraordinary opportunity for this government to get emissions reductions this decade which are critical. And the only way where the majority of those are this decade is in our vehicles and our homes. Because we don't have green steel yet. We don't have green hydrogen yet. They would address the cost of living crisis and the government could do concessional financing, so they could either buy down the interest rate the biggest problem in America and Australia is probably 60% or more of homes don't qualify with a credit rating that allows banks to lend them the money.

So while a single mother in Western Sydney would absolutely save $2,000-$3,000 a year on gasoline even if she's a nurse her credit rating probably isn't good enough to finance an electric car to access those savings. There are ways that the Australian government could step in either by backstopping the banks or guaranteeing the banks doing something like income contingent loans which is how we finance their education system. And if you look at the macroeconomics, it's a slam dunk for the country. If all of Australian households were all electric, we'd save $40 billion a year. The problem with revenue neutral, because you brought up the thing that I hate the most is we have an obstructionist treasury that thinks the country is broke, that wants it to be revenue neutral.

And the problem is like a —

David Roberts

Like a household budget, Saul.

Saul Griffith

Right. But that's because they think that they will pay the costs and the households will receive the benefit and that that's not revenue neutral —

David Roberts

Well the households pay fucking taxes!

Saul Griffith

They don't understand that the households will take all that savings, they'll spend it elsewhere in the economy and the government will see back in taxes.

David Roberts

They're not lighting the money on fire.

Saul Griffith

David Roberts can we end with your Jedi mind trick that convinces Australia's neoliberal treasury that this is a fucking great idea and they should do it to save the world?

David Roberts

Yeah. I mean, this, I feel like, is in the wake of IRA, even in the US. But also here, definitely: This is sort of one of the last barriers to truly good policy, is just breaking this notion that the government has, like, this box of money, and when it spends it, it's gone. And then the government's broke. Like, no household behaves that way, no business behaves that way, no growth enterprise is revenue neutral. And why would it be? And so you give money to households, they flourish they spend money —

Saul Griffith

Government flourishes.

David Roberts

They pay taxes.

Saul Griffith

Here's an extraordinary thing that I —

David Roberts

Spend money to save money, spend money to make money.

Saul Griffith

I'm not sure if this is a useful idea but I keep getting stuck on this: Australia's housing stock is worth about $100 trillion. It would cost you far less than $1 trillion to electrify all of the households, including all of their vehicles, over the next 20 years. You'd be zero emissions by 2040 and for less than 1% of the value of the asset base. We're there. Like absolutely, you don't need to be a banker to know that we can afford to do that.

David Roberts

Yes. All right, well, let's finish on that note. One last gut punch to neoliberalism. Seems like a good place to wrap up. Thanks so much for coming, Saul. It's been a delight doing this. I've meant to have you on the pod forever. We'll probably do it again sometime, but good luck cracking heads in Australia, getting people — and I hear rumor has it that big things are in the works relatively soon. October-ish, November. Albanese is going to DC, I think, in October, November and may or may not announce something.

Saul Griffith

We will either see something — the announcements in America will likely be, you know, we'll give you cheap lithium if yo give us big monster trucks.

David Roberts

Oh Jesus.

Saul Griffith

My KPIs are, or OKRs, I can never remember the difference between the two damn things. Neoliberals invented both of them. But my KPI is federal budget of next year. Are we fixing the tax code structurally in a way that enables this to happen? And then what is the platform climate-wise for this government for the next election? And they will be the political moments where we know we've either done a better job of the IRA or whether we've been lackeys to the gas and coal industry and we're merely trying to squeeze a few extra dollars for some multinationals out of there —

David Roberts

Ha, right. All right, with that, we'll conclude. Thanks so much, Saul. Thank you for listening to the Volts podcast. It is ad-free, powered entirely by listeners like you. If you value conversations like this, please consider becoming a paid Volts subscriber at volts.wtf. Yes, that's volts.wtf so that I can continue doing this work. Thank you so much and I'll see you next time.

Share this post